London’s Property Market 2024: Your Questions Answered

What can we expect from the London property market this year? As winter gradually turns to spring, many Londoners are thinking about moving home. But what are the prospects for buying, selling or investing in property in 2024?

This month, we have put together some of the questions property buyers and sellers have been asking our sales teams in Westminster, London Bridge, and Kennington.

Will 2024 be a good year to sell your property?

We have seen a switch from the overheated seller’s market of recent years to a buyer’s market. Certain commentators have suggested that the capital’s house prices could fall as much as 4 per cent in 2024. However, while London property prices may continue to soften in some areas, there is little prospect of the price crash that some had predicted.

The London Evening Standard has called 2024 “the year to buy – if you can” and this renewed optimism is encouraging more buyers to enter the market. In prime London areas such as Westminster, we have seen a rise in the number of properties going under offer, while the rate of fall-throughs and withdrawals has dropped. This flurry of activity has yet to convert into confirmed sold prices, but the promise of a market revival is encouraging sellers, and as a result we have seen an increase in the number of new listings coming to market.

Realistically priced properties are more likely to sell quickly at the present time. That’s not just because mortgages are more expensive for buyers; it’s also due to increasing competition as more properties are listed (Rightmove has reported that new listings are up by 15 per cent). However, improving mortgage affordability - a result of lower mortgage rates and rising wages - should help support property values this year.

If you are unsure about what price you could achieve, why not ask us for a free, no obligation property valuation?

What can first time buyers expect in 2024?

London’s first time buyers have faced the triple challenge of costly mortgage rates, high house prices and rising rents that make it harder to save for a deposit. But good news could be on the way.

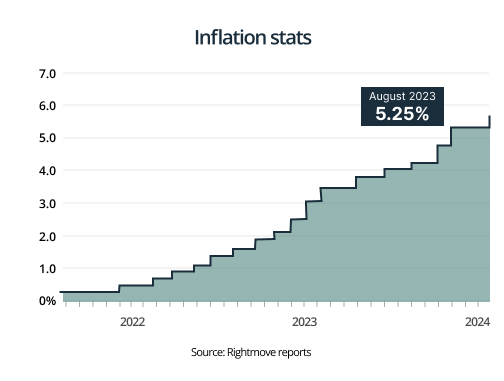

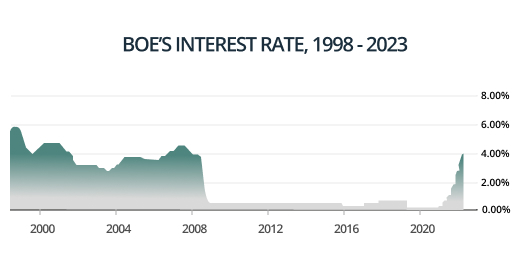

Currently all eyes are on the Bank of England (BoE). Last year the Bank began to increase the base rate - which affects the cost of mortgages – in order to drive down inflation. Today, inflation is running at 4 per cent, but that’s not low enough for the BoE to reduce the rate. The Bank has pledged to wait until it registers at just 2 per cent and is therefore reluctant to make any changes now. However, a decision on lowering the rate is expected before the summer, when it is expected to fall to 4.75 per cent.

Last July, inflation rose to 6.86 per cent, triggering a base rate rise to 5.25 per cent. Fortunately, economists now believe that these incremental bank rate rises have reached their peak. Since last summer we have seen major lenders make a series of mortgage rate cuts, as confidence in a slowdown of inflation grows. Most high street banks are now charging less than five per cent on a five year, fixed rate deal. Some are even offering fixed rate deals at under four per cent, which will be positive news for first time buyers.

Additionally, more 100 per cent mortgage products are becoming available. That means you can obtain a loan for the full value of the property you are buying, without the need for a deposit. Several high street banks and building societies are now offering 100 per cent mortgages, so it’s worth shopping around. However, these mortgages will be more expensive: buyers able to provide larger deposits (when compared to the value of the property) are generally offered more favorable mortgage terms.

As we’ve already noted, banks are currently reducing the cost of mortgages and there are indications that the next rate reduction may be implemented as early as May this year.

Where is the London housing market heading this year?

As 2024 gathers pace, London’s property market continues to demonstrate its adaptability and resilience. The London Evening Standard predicts that prices are “set to rise again after a turbulent year”.

In spite of the economic challenges presented by Covid, Brexit and the war in Ukraine, market conditions are now improving. This has occurred thanks to a combination of high domestic demand, international interest and changes in buyer preferences.

Three quarters of the UK's costliest homes are purchased by cash buyers, and have therefore been less affected by the mortgage rises that have buffeted the mainstream market. London’s £5m plus property price market has dipped by 17 per cent over the past year, but values nevertheless remain at historically high levels. Figures recorded in January show they are still 64 per cent higher than in the pre-pandemic years of 2017 to 2019.

Rightmove reports that sold prices in Westminster were 10 percent down on the previous year, at levels similar to the 2019 peak of £1,753,736. Prices fell by 4 per cent over the year in the SE1 postcode areas around London Bridge, with an average property price of £705,115 for a flat. In Kennington, values dropped by 11 per cent last year, with apartments attracting an average price of £518,651.

As 2024 progresses, we expect to see continuing demand in central London districts that offer good travel links, access to cultural amenities and excellent educational opportunities. These areas are particularly popular with overseas buyers.

If predictions that the pound will weaken later this year are confirmed, foreign buyers will be drawn to purchase properties in the capital in even greater numbers.

How will London’s property market fare beyond 2024?

London rents are already set to increase by 5.5 per cent this year, and forecasts suggest that they will continue to rise. This will make the prospect of purchasing a property more attractive to renters who can afford to buy a new home.

Although mortgage affordability is still an issue at the moment, January saw a strong rebound in interest from property buyers. If mortgage rates begin to fall from mid-2024 onwards, we can expect to see a further increase in demand for properties. Momentum is likely to build year on year as the cost of a mortgage declines.

Industry insiders expect to see an annual, incremental fall in the base rate after 2024. The highest levels of property price growth are expected in 2027, when the base rate is forecast to fall to 1.75 per cent. By 2028, it is predicted that an average home in the capital will be worth £70,376 more.

How can I get the best results from buying or selling this year?

London shouldn’t be considered as a single property market but as a collection of micro markets, each with its own values and levels of demand. That’s why deep local knowledge is vital if you want to get the most from your property transaction.

For thirty years, we have been successfully helping people buy, sell and rent in London, and we would love to help you with your next move. Simply call the friendly sales teams at any of our offices to let us know what you need.